An ABA number, also known as a bank routing number, is a nine-digit code that identifies banks in the U.S. That number makes it possible for banks to transfer money to and from your accounts for transactions like wire transfers, direct deposit, and automatic bill payments. Your routing number is there to make sure your payment arrives to its recipient safe and sound.

This page is a great place to start when you're looking for your Bank of America routing number. But it's always worth checking the right account and routing number with your bank or your recipient. The Federal Reserve Board of Governors in Washington DC. Board of Governors of the Federal Reserve System. The Federal Reserve, the central bank of the United States, provides the nation with a safe, flexible, and stable monetary and financial system.

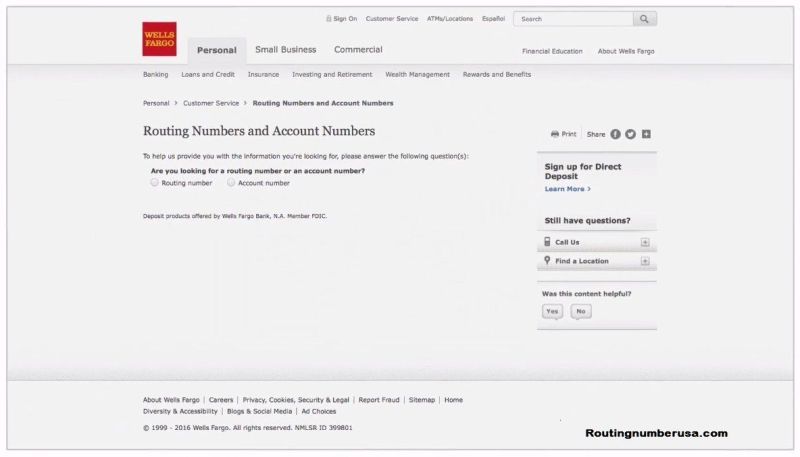

Routing numbers are codes of between 8 and 11 digits used by Wells Fargo and other banks to help financial institutions identify the location of your account. Called ACH, wire transfer and SWIFT numbers, they're used to process checks, set up autopay, make online payments and transfer money in the US and around the world. Learn how to find the exact routing number you need for your Wells Fargo account. From setting up direct deposit to making ACH payments and wire transfers, you'll need a routing number to complete many kinds of banking transactions. As a large national bank, Wells Fargo has a different routing number for each state, as well as different numbers for domestic and international wire transfers.

Once you find your routing number, you can send money, set up direct deposit, ACH payments, and even make a domestic or international wire transfer. Your bank routing number is a 9-digit code used to identify a financial institution in a transaction. It's based on the location of the bank where your account was opened.

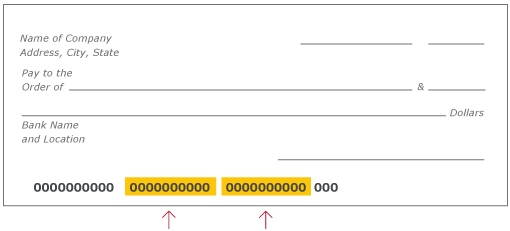

It is also referred to as an RTN, a routing transit number or an ABA routing number and can be easily be found printed on the bottom left side of your check. The Fedwire Wire Transfer service is the fastest way to transfer funds between business accounts and bank accounts in the USA. The SWIFT Code is a standard format for Business Identifier Codes that is used to uniquely identify banks and financial institutions globally. These codes are used when transferring money between banks, especially for international wire transfers or SEPA payments. When 8-digits code is given, it refers to the primary office.

When transferring money in Europe, you will often be asked for a SWIFT/Bic number. You can receive funds to your Wells Fargo Bank account from any bank within USA using domestic wire transfer. You need to provide the following details to sender of the funds who will initiate the domestic wire transfer through his/her financial institution.

SWIFT codes are used to identify banks and financial institutions worldwide. They are used by the swift network to transmit wire transfers and messages between them. For international wire transfers, swift codes are always required in order to make transactions secure and fast. The American Bankers Association routing numbers are solely used for ACH transfers. Domestic wire transfers must only be completed through local ACHs within a day. In the country of the receiving bank, international wire transfers must also clear an ACH that adds to the procedure another day.

Factors like holidays at banks, time zones, weekends, and mistakes in detail may delay wire transfer. It is also essential that account numbers and bank codes be checked before a wire transfer is completed. The ABA routing numbers are useful only for ACH transfers. ACH Routing Numbers is an acronym for for Automated Clearing House routing numbers. This number is used for America electronic financial transactions.

The first four digits identify the Federal Reserve district in which the bank is located and the following four numbers identify the bank. The last number is referred to as a check digit number, which is a confirmation number. ACH Routing Numbers are used for direct deposit of payroll, federal and state tax payments, dividends, annuities, monthly payments and collections.

International wire transfer is a popular way to receive money from foreign countries. All Banks use the SWIFT network for performing international wire transfers. A Routing Number enables Federal Reserve Banks to process Fedwire funds transfers, and to process bill payments, deposits, and other transfers via the Automated Clearing House. Routing numbers are necessary when bank customers are paying bills by phone by using a check, when reordering checks or when a bank account holder sets up a direct deposit. For international wire transfers, the special type of routing number you'll need is called a SWIFT code.

Wells Fargo uses the same SWIFT code for all international wire transfers, for both sending to and receiving from an international bank account. International wire transfer is one of the fastest way to receive money from foreign countries. Banks use SWIFT network for exchanging messages required for performing international wire transfer.

Usually, the receiving bank and the sending bank need to have a direct arrangement in place to start the swift transfer – this is sometimes referred to as correspondent banking. US banks use the same CHIPS and Fedwire systems to process international wire transfers. Instead, they send wire instructions using the Society for Worldwide Interbank Financial Telecommunications codes instead of the local bank routing number. SWIFT is a worldwide non-profit organization consisting of over 9,000 institutions.

A routing number is a nine digit code, used in the United States to identify the financial institution. Routing numbers are used by Federal Reserve Banks to process Fedwire funds transfers, and ACH direct deposits, bill payments, and other automated transfers. It's free for most users and is a great alternative to a traditional wire transfer. Again, the ability to complete a transfer via Zelle or any other money transfer app depends on the bank of the recipient, how much you're sending, and where the bank is located. Wells Fargo Bank's Routing Number will be very necessary for you when you need money transfers. You can not transfer your money without this one of this code.

Because If you want to send money, you need to use your branch details for recognizing you and your bank. Always use the correct routing number before you initiate a money transfer. Domestic wire transfers in the US, however, communicate transaction instructions through CHIPS or Fedwire networks. On the other hand, international wire transfers use SWIFT, a network of more than 10,000 banks and financial institutions across 200 countries. Usually, the exact routing number is close to the bottom of the cheque, where you can identify the financial institution in which it is designed. The check number, sometimes called the ABA number or SWIFT code, can manage an account and transfer money from one bank account to another.

A routing number is a nine-digit numeric code printed on the bottom of checks that is used to facilitate the electronic routing of funds from one bank account to another. It's also referred to as RTN, routing transit number or bank routing number. For example, you will be asked for both your routing and account number if you set up employee direct deposit or automatic bill pay. Both numbers will also be required when you order new checks and when you send or receive a wire transfer. Wells Fargo routing number is a unique nine-digit number usually at the bottom of a check. It identifies the financial institution on which it was drawn or printed.

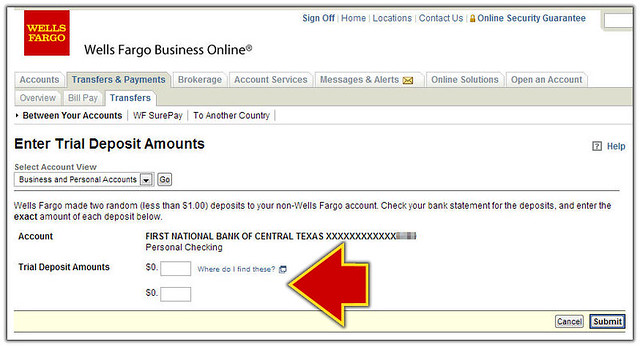

Wire transfers are a quicker way to send money than an ACH transfer. Anyone can wire funds to your Wells Fargo account for a small fee. You can even set up a domestic or international wire from your local Wells Fargo branch. Now you'll see the routing number for direct deposits, electronic payments, and domestic wire transfers.

Routing numbers are also known as "Check Routing Numbers", "ABA Numbers", or "Routing Transit Numbers" . The ABA routing number is a 9-digit identification number assigned to financial institutions by The American Bankers Association . The number determines the financial institution upon which a payment is drawn. Each routing number is unique to a particular bank, large banks may have more than one routing number for different states. Routing numbers may differ depending on where your account was opened and the type of transaction made. If you bank with Wells Fargo, then knowing your routing number is important when managing your money.

Having your routing number will help you set up direct deposit, automatic payments, or wire transfers. If we analysis this Wells Fargo Bank's 9 digit Routing Number, we will get the first 4 digits to represent the Federal Reserve routing symbol. The next 4 digit numbers are the American Bankers Association identifier Number. This 4 digit number helps define the financial institution which you opened your account. And the last 1 digit number is the check digit that is usually calculated using an algorithm. This last 1 number is used to authenticate the 8-digit bank routing number.

This number used to validate a check digit by calculating the algorithm and comparing it with the one that is printed on the check. Wells Fargo Routing Number is a necessary code used when doing money transfers. If you want to send money, you need to use your branch details usually recognizable by the routing transit number. Using the correct routing number before you initiate a money transfer is vital. If you are looking for Wells fargo bank routing number for wire transfer, then you are at right place. Here, we are going to full list of Wells fargo bank routing number with address.

Routing numbers help banks identify your exact account to make digital payments, transfer money and even process paper checks between branches, states and countries. Learn more about how Wells Fargo and other financial institutions use these codes to manage your money in our guide to routing numbers. Wire transfer is the fastest mode of receiving money in your Wells Fargo Bank account.

You can receive money from within USA or from a foreign country . The transaction is initiated by the sender through a financial institution, however and need to provide your banking details to the sender for successful transfer of money. Is it time for you to open a bank account for your child? The best bank accounts for kids include features that help you teach them about money management, earning interest, and more. Here are the details regarding some of the best checking and savings accounts for getting your kids on the path to great money management in adulthood. A routing number, also called the ABA routing transit number , is a nine-digit code that indicates the financial institution you bank at.

They are unique to each bank and allow the accurate transferring of money between financial institutions. You can receive funds to your Wells Fargo account from any bank within USA by using a domestic wire transfer. To successfully transfer the money, Wells Fargo wire transfer routing number, account number and swift code are needed. To complete a wire transfer, you usually need the name of the recipient, their bank name, and account number. Depending on the banks that both the sender and the recipient use, it's possible to initiate a wire transfer via the bank itself.

Or, it can be done through a third-party money transfer service such as Western Union. And, there are almost always fees involved, both for incoming and outgoing transfers both internationally and domestically. Wells Fargo has different services to appease every type of customer. Some accounts that clients can choose from include checking accounts, savings accounts, certificates of deposit, and credit cards.

Whether you are dealing with your first account or have been banking for decades, Wells Fargo has an option account for you. Remember, Of course, You need to verify your Wells Fargo banks routing number before you start any kind of money/fumd transaction. You must know your state name, and your account type to get your routing number. It is important to use the correct routing number for the money transaction. Because the routing number on your check may be some time differ from the routing number you would use for a wire transfer.

There is no limit to the amount of funds that can be sent through a wire transfer . If you are a business customer submitting a wire transfer online, you may have limits set that are specific to your business. If you request the wire transfer over the phone, there may also be reduced limits.

For the most security, request a wire transfer in a Wells Fargo branch location. If you have a foreign bank account, you can request the foreign bank send a wire transfer to your Wells Fargo account. As a Wells Fargo customer, you can send money online or in person, and you can also receive wire transfers. You'll need to gather required information so that the wire can go through smoothly. Also confirm what fees you will pay, because you can't send or receive money for free. Likewise, credit cards do not have routing numbers since they are not directly linked to any bank account.

Incoming and outgoing international wire transfer costs depend on the provider, destination, transaction amount, and the mode of sending money. They can also cost more if you choose to use Wells Fargo's foreign currency exchange service. Setting up direct deposit, sending wire transfers, ordering new checks, and sending money to someone all require a routing number. The routing number for domestic and international wire transfers for Wells Fargo are the same across all states. The checking and saving account routing number and the ACH routing number for Wells Fargo varies state by state, you can find these in the table above. Use these details to receive an international wire transfer in your Wells Fargo account.

For checking accounts, you can find the routing number of any financial institution by referring to the bottom left-hand corner of a check from them. It is the first 9 digits located sequentially at the bottom of the check. Some wire transfers might ask for an IBAN, which is a set of numbers that create a code for transfer in Europe. The US doesn't currently participate in IBAN, which means no American bank will provide you with an IBAN code. If you're transferring money to an account in Europe that does use IBAN, you can usually find it by visiting their website or asking the recipient for the number. How much are Wells Fargo's wire transfer fees and how do you send a wire transfer through Wells Fargo?

When it comes to checking accounts, Wells Fargo has plenty. Each of them comes with a Platinum Debit card with chip technology, making purchases an absolute breeze. Routing numbers are used to identify US banks and other financial institutions. Typically made up of nine digits, routing numbers can also be referred to as ABA routing numbers, or even RTNs. The American Bankers Association usually manage the official routing number registrar.

This is the common question for all users of Wells Fargo Bank. The Wells Fargo Bank's Routing Number is an international code which is used to identifies particular banks worldwide. Wells Fargo Bank uses SWIFT codes to send and receive money to for their customers amoungs international overseas banks. SWIFT codes, as you now know, are special routing numbers banks use to make international wire transfers. As it turns out, BIC codes are another name for SWIFT codes, short for "bank identifier" codes.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.